Many very intelligent and successful investors have been dead wrong about the U.S. equity market rally for the last couple of years. The list of bearish billionaire investors continues to grow. Recall that these “smart money” investors turned fully bearish over the summer of 2016! The main argument of these successful investors is that stocks are overvalued by traditional valuation metrics. And their analysis would be correct…in normal times.

How wrong have value-oriented investors relying on past standards been? Well, we updated our valuation indicators for the U.S. market which demonstrate how useless traditional valuation measures currently are.

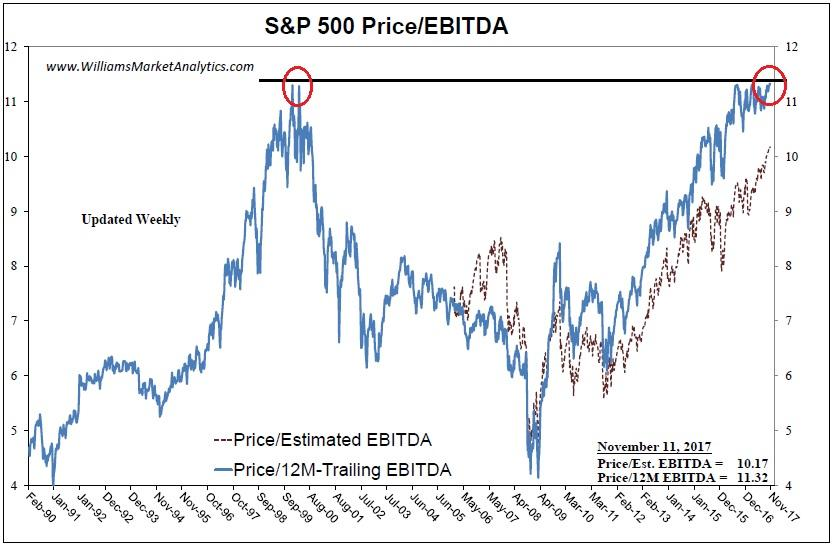

First, we show our price/earnings measure using EBITDA earnings instead of bottom-line earnings, which are of course much more manipulated by management. Using trailing 12-month EBITDA earnings, we see the S&P 500 is trading at 11.3x, just like in March 2000. Using optimistic forward earnings projections, our P/E measure falls to 10.2x, which is still 20% above the prior bull-market peak.

Next, S&P 500 operating earnings have completely decorrelated from the S&P 500 index price.

And the size of the U.S. stock market relative to the size of the U.S. economy well exceeds peaks seen at prior bull-market highs.

The much publicized cyclically-adjusted Shiller P/E (below) now at 31.5x has broken above the Black Tueday peak from 1929. An investor playing this bull market would need a healthy dose of optimism to expect the Shiller P/E to come close to the Tech Bubble valuation record of 44.5x.

Of course those who are cheering on the rally can cite many reasons why standard valuation measures no longer work and why “this time it’s different”.

First, exceptionally low interest rates “justify” higher stock valuations. Most readers know that over the course of an economic expansion, it is the role of central banks to gradually “take away the punch bowl” to prevent the economy from overheating and inflation from getting out of control. In this economic cycle, characterized by below-trend (3% annual) GDP growth, central bankers have not seen an inflation risk. Ergo, there has been no need to take away the punch bowl. To prevent this Commentary from morphing into a treatise on central bank policy errours, we’ll just say that the central banksters (either deliberately or involuntarily) have not wanted to see the inflation in the world today. For example, the Fed’s focus on the PCE (personal consumption expenditures) measure as a gauge of inflation has allowed the central bank to maintain its “lower for longer” policy. How the central bank can inject trillions of dollars into the economy, then assume that this is not inflationary, is beyond us. Maybe we are pessimistic, but is seeing run-away inflation in financial asset prices really that much healthier than if the inflation manifested itself in the PCE ?

The second reason is the “cash on the sidelines” argument. The “too much cash on the sidelines” argument for buying dips can’t be valid forever. And last time we checked, the Fed message was that of tightening monetary conditions through rate hikes and balance sheet reduction. Yes, rates are inappropriately low for this stage of the cycle. But at the same time, aggregate world money printing (Fed, + ECB + BoJ) is slowing.

Our conclusion is that valuations indeed do not matter…in the short-run. This makes investing much more a crap shoot today, as thoughtful analysis has much less to rely on. What matters today is momentum: buying begets buying. As long as the trend is up, price dips will pop higher right away. This is not a profound insight, but it is the reality. One thing that we know for sure is that professional traders who are still buying equity know exactly at what price they’ll be getting out. The foreseeable result is that when momentum does turn down, passive investors will be confronted with a decision to exit their positions at levels much lower than today…after the savvy investors are in cash (or in short positions). But this is the implicit game that all investors who remain in equities are playing. Those who espouse to be “long-term investors” will inevitably change their tune when portfolio gains turn into portfolio losses. The question once remains: when will valuations matter again?