January 22, 2025

The recent surge in equity markets raises a crucial question: is this upward momentum driven by genuine investor confidence or easier money conditions? Let’s consider the events of the past six weeks.

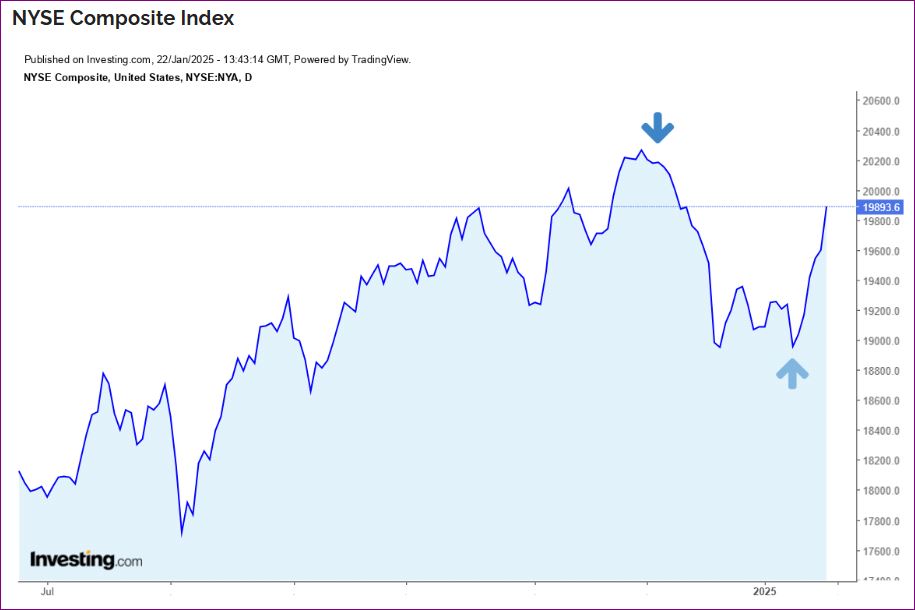

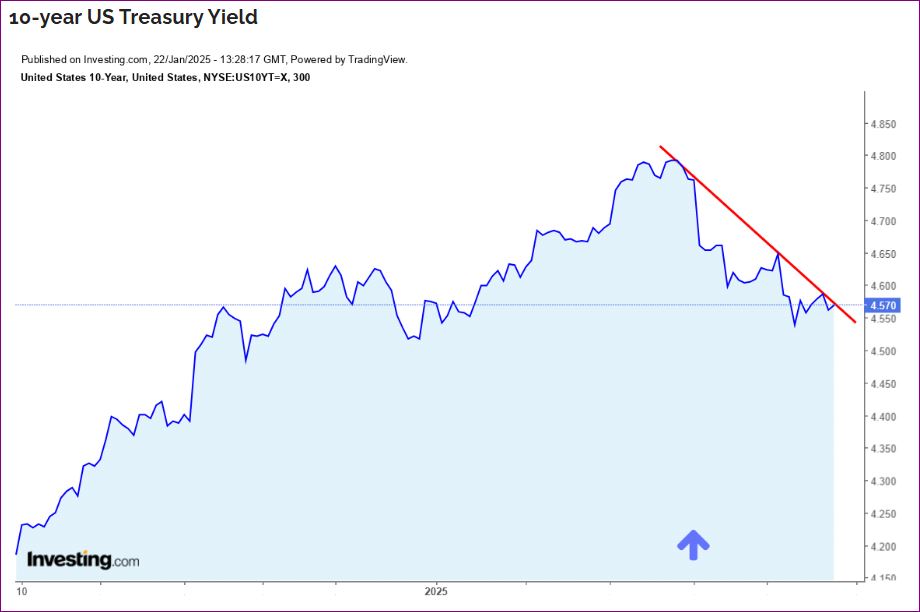

In my “Imminent Threat” warning on December 4 (down arrow), I cautioned about tighter money conditions. Specifically, I pointed to the US 10-year Treasury yield guidance I expected to be included in the January 15 pre-open earnings report of JP Morgan. That morning, January 15 (up arrows), the major financial institutions I refer to as “Humongous Bank & Broker” (HB&B) decided to push money into the market directly and through loans to traders and investors. This injection of liquidity lifted the bond price, dropped the yield, and led the market like a pied piper to buy asset prices higher.

The sequence of events demonstrates that HB&B’s actions to tighten and ease money conditions preceded and triggered the subsequent decline and rise in investor sentiment. This pattern has played out repeatedly in market cycles. Yet, many market participants attribute price movements primarily to their own collective wisdom and trading decisions or to the Fed.

What we’re witnessing isn’t a genuine reflection of investor confidence, economic fundamentals, or New York Fed policy operations. Rather, it’s a carefully orchestrated liquidity dance led by HB&B. The institution knows exactly how to manipulate market psychology through strategic money supply adjustments, creating a self-fulfilling prophecy where easier money conditions spark buying activity, generating momentum and attracting more investors.

The Fed’s job is to reign in HB&B whenever the money supply exceeds its targets. The endgame is predictable: HB&B controls market prices by liquidity injections and withdrawals. After pushing out loans, which they do when the banks undergo share buyback decisions, if asset prices reach levels where they determine the risk-reward ratio no longer favors further appreciation, HB&B will methodically withdraw liquidity from the system. This will trigger another cycle of asset price deflation, setting the stage for the next round of this well-worn pattern.

However, when HB&B sometimes fails to comply with the Fed federal funds policy rate target range, the Fed will raise or lower it. If that is insufficient, the Fed will further enforce its policy by altering the interest rate it pays on the funds that banks hold as reserve balances and changing its overnight repo rate and discount rate.

So the Fed is the referee, but the banks are the players.

Let’s examine these events more closely. Immediately following the Federal Reserve’s December 18, 2024 decision to cut interest rates by 25 basis points, the equity markets experienced a sharp decline of nearly 3%. Despite the Fed’s move to lower the target range to 4.25%-4.5%, signaling a more accommodative monetary stance, the market reaction was unexpectedly negative.

This drop, which started earlier in the month and was identified in my December 4 warning, should be largely attributed to the rise in interest rates across the curve by approximately 10 basis points, driven solely by HB&B’s actions.

Before the market opening on January 15, JP Morgan released its earnings report, which was absent guidance on interest rates. Investors immediately interpreted that omission as a bullish signal, and equity prices soared. The next Fed meeting, however, is not until January 28-29, which removes them from the cause of that investor bullishness.

The market’s responses in mid-December and mid-January highlight a recurring dynamic where HB&B’s influence on liquidity conditions overshadows the Federal Reserve’s policy intentions. While the Fed aimed to ease monetary conditions in December, HB&B effectively counteracted this by increasing borrowing costs, which tightened financial conditions and spooked investors.

This divergence underscores the outsized role that large financial institutions play in shaping market outcomes, often at odds with the Fed’s objectives. The narrative that places blame solely on the Federal Reserve for market volatility is overly simplistic and misleading. The real issue lies in how HB&B manipulates liquidity flows and interest rates to serve its own interests.

By raising rates across the curve despite the Fed’s cut, HB&B created a perception of tighter money conditions, which dampened investor sentiment and worsened the December sell-off in equities. The mid-January turnabout initiated by JP Morgan immediately reversed the perceptions and actions of investors. This pattern reflects a broader structural issue within financial markets: the disproportionate power of large financial institutions to influence economic outcomes.

The foregoing might be acceptable except for the fact these for-profit institutions are trading against their clients. Fiduciary institutions should never have been given such a privilege, particularly when they use our money to fund their trades.

My hypothesis, in summary, is that while the Fed sets monetary policy, its effectiveness is frequently undermined by HB&B’s actions, which can amplify or negate the intended impact on liquidity and credit availability. As a result, market participants are left navigating a landscape shaped more by institutional maneuvers than by central bank policy, macroeconomic fundamentals, or corporate earnings. In conclusion, while media-driven narratives continue to frame the Federal Reserve as the primary driver of market movements, it is essential to recognize the pivotal role of HB&B in steering liquidity conditions and investor behavior.

The banks—not the Fed—remain at the core of this ongoing tug-of-war over market dynamics. It’s a game they always win where we often lose. I call it for what it is: unfair.