December 23, 2024

When the US government needs money to pay its bills, and investors find better investments in the stock market, the Treasury is forced to pay higher interest rates. This ongoing dynamic is between the yields available from stocks and treasuries.

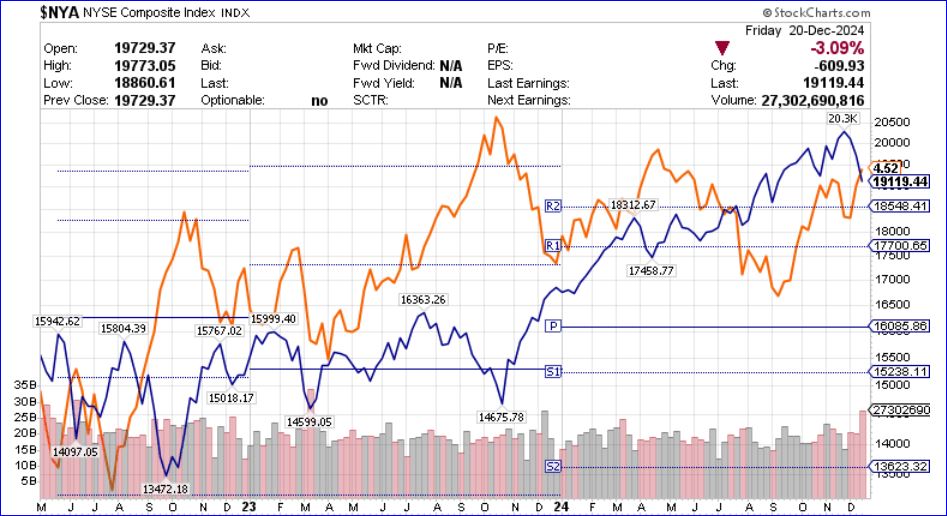

In the chart below, I show the New York Stock Exchange Index ($NYA) in blue and the 10-year Treasury yield ($UST10Y) in orange. As the Treasury yield increases, stock prices fall (which increases equity yields), and vice versa.

One of the reasons that on December 4, I published “The Imminent Threat of a Market Crash,” is because Treasury yields are rising to a point where stock prices break down. Trump 2.0 policies regarding tariffs bring risk to the market as inflation increases, interest rates increase and investors decide that capital risk in equities is not worth investing in. They will sell stock, buy bonds, or move to the sidelines in cash until interest rates fall again.

I selected January 15 (Before the Market Open) as the turning point because that’s when JP Morgan Chase Bank (JPM) reports its 4th quarter. I anticipate satisfactory revenues, profits, and dividends to be reported. The fly in the ointment will be in the company’s notes, indicating concern for government and personal debt and its guidance for higher interest rates in 2025. The other major US banks and brokers (HB&B) will align with JPM because this concern is legitimate.

Even Trump wants to lift the debt ceiling because he knows his policies will have short-term negative consequences to achieve the long-term prosperity he claims.

Regardless of the chatter in Congress, anticipated spending and Trump’s tax cuts will push the national debt much higher. Interest rates will rise. Stock prices will fall. Trump will blame the Fed, and Musk will repeat his new mantra that the Fed is “grossly overstaffed.”

Musk makes this point because he wants the public to think the Fed is a government agency that POTUS controls. He knows that not to be the truth. The Fed is a private organization that, in association with HB&B, controls the US money supply, which impacts interest rates. The Fed uses the term policy rate because it does not set interest rates; the banks do. POTUS does not control the Fed or HB&B. These are not government agencies like the Treasury.

So now you understand the dynamics, you can see why I believe 2025 will be a year of suffering for investors who fail to protect their investment funds from market risk.