April 24, 2025

A multi-million-dollar TV campaign in Mexico by US Homeland Security is (a) being stopped by the Mexican government, and (b) going viral worldwide, causing many countries to file US travel warnings.

The ‘We will hunt you down’ theme, and the evidence that some innocent travelers have been ‘captured’ at the border and imprisoned have consequences. What had been severe cutbacks in travel in February, increased in March, and are worsening.

From AI-generated data, including projections, these figures appear reasonable:

(i) Mexico

- February 2025:

- Air travel from Mexico to the US fell by 6% compared to February 2024.

- No specific data for land crossings was reported for February, but general trends suggest a decline due to border enforcement concerns.

- March 2025:

- Air arrivals from Mexico dropped by 23% year-over-year compared to March 2024.

- Land crossing data is still pending, but Mexico, as the second-largest inbound travel market, saw reduced travel due to stricter border policies and negative sentiment.

- April 2025:

- Specific data for April is not fully available. However, air travel from Mexico was reported to be down by 17% in March, with expectations of continued declines into April due to ongoing border concerns and visa issues.

- Preliminary trends suggest a sustained drop, potentially aligning with the 15% overall decline in air arrivals from top inbound markets reported for March.

(ii) Canada

- February 2025:

- Land border crossings from Canada to the US decreased by 14.6% in daily travelers (from 92,983 to 79,407 daily average). Total crossings dropped by approximately 500,000 compared to February 2024, equating to a 23% decline in Canadian return trips by automobile.

- Air travel saw a 2.4% decline in Canadian return trips compared to February 2024.

- Overall, visitor numbers across the northern border were down 12.5% year-over-year.

- March 2025:

- Land crossings saw a 31.9% year-over-year decline in Canadians returning by car, with some border crossings reporting up to 45% fewer crossings on certain days.

- Air arrivals from Canada fell by 13.5% compared to March 2024.

- Total visitor numbers from Canada were down 18% year-over-year.

- April 2025:

- Exact data for April is sparse. However, advance bookings for Canada-to-US routes were down by over 70% for the summer season, suggesting a continued sharp decline in both air and land travel.

- The trend of reduced travel is expected to persist due to ongoing trade disputes, tariffs, and political rhetoric, with projections estimating a 15.2% overall decline in inbound travel for 2025.

(iii) Other Countries

- February 2025:

- Overall international arrivals to the US saw a 2% year-over-year decline.

- Specific declines from countries other than Canada and Mexico were not detailed, but Western Europe (a major source) showed early signs of reduced travel, with a 10–40% drop in travel consideration from markets like the UK, Germany, and France.

- Air travel from Brazil dropped by 15% between January and February.

- March 2025:

- Overseas visitor arrivals (excluding Canada and Mexico) contracted by 11.6% year-over-year.

- Specific declines include:

- Germany: 28% drop in visitors.

- UK: 29% drop in visitors.

- Spain: 25% drop in visitors.

- Colombia: 33% drop in visitors.

- Western Europe overall: 17% decline.

- Central America: 24% decline.

- Caribbean: 26% decline.

- Japan saw a decline, though less severe, while South Korea reported an increase in bookings, insufficient to offset broader losses.

- April 2025:

- Data for April is incomplete, but the top ten US airports reported a 20% year-over-year drop in foreign arrivals in March, with trends likely continuing into April.

- Preliminary data from Hartsfield-Jackson Atlanta International Airport showed a 5% decrease in non-US passengers from March 1 to April 7 compared to the same period in 2024.

- The overall decline in international arrivals was reported at 11% for March, with expectations of sustained or worsening declines due to global trade tensions and travel advisories from countries like the UK, Germany, and France.

Summary and Context

- Mexico: The decline started at 6% in February (air) and worsened to 23% in March (air), with a likely continued drop in April (~17% based on trends). Land crossing data is less clear but likely follows suit due to border enforcement concerns.

- Canada: The most significant declines were in land travel, dropping 23% in February and 31.9% in March, with air travel down 2.4% (February) and 13.5% (March). Summer bookings probably fell by 70% in April.

- Other Countries: A 2% overall decline in February grew to 11.6% for overseas visitors in March, with sharp drops from Europe (e.g., Germany 28%, UK 29%) and Latin America (e.g., Colombia 33%). April trends suggest a 20% drop in airport arrivals, with a sustained 11% overall decline.

- Factors: Declines are driven by US tariffs, trade disputes, stricter border policies, high-profile detentions, and negative political rhetoric, particularly affecting Canada and Mexico. Travel advisories from countries like the UK, Germany, and France, along with visa delays and policies on gender markers, further deter travelers.

- Economic Impact: The US Travel Association estimates a 10% reduction in Canadian travel alone could lead to $2.1 billion in lost spending and 14,000 job losses. Overall, inbound travel spending could drop by $18–22 billion in 2025.

Notes

- April 2025 data is incomplete, and projections are based on March trends and booking patterns.

- Land travel data for Mexico is less reported but assumed to follow air travel trends due to shared border policy impacts.

- Easter’s later timing in 2024 (March) versus 2025 (April) may partially explain some March declines, but policy and sentiment factors are primary drivers.

A steep drop in foreign visitor travel—especially from Mexico and Canada, which together account for over 50% of inbound travel to the US—would significantly impact several major travel industries and the largest US travel companies that rely on international tourism.

US Inbound Tourism (2023)

- Total visitors: 66.5 million

- Top source countries/regions:

| Region/Country | Visitors (Millions) | Share of Total |

| Canada | 20.51 | ~30.8% |

| Mexico | 14.5 | ~21.8% |

| Europe & UK (estimated) | ≥7.33 | ~11.0% |

| – UK | 3.9 | ~5.9% |

| – Germany | 1.84 | ~2.8% |

| – France | 1.59 | ~2.4% |

| Asia (partial data) | 3.36* | ~5.1% |

| – India | 1.76 | ~2.6% |

| – South Korea | 1.6 | ~2.4% |

Largest Travel Industries Most Affected:

- Airlines – Reduced demand for international flights.

- Hotels & Lodging – Lower occupancy rates, especially in tourist-heavy cities.

- Car Rentals – Fewer international travelers renting vehicles.

- Tour Operators & Attractions – Theme parks, museums, and guided tours see fewer visitors.

- Cruise Lines – Many US cruises depend on foreign travelers flying in.

- Restaurants & Retail – Tourist-heavy areas (e.g., NYC, LA, Orlando) lose spending.

- Conventions & Business Travel – Fewer international attendees at trade shows.

Largest US Travel Companies at Risk:

Airlines:

- Delta Air Lines (DAL) (major international routes)

- American Airlines (AAL) (heavy reliance on Mexico/Latin America travel)

- United Airlines (UAL) (transatlantic/transpacific routes)

- Southwest Airlines (LUV) (large US-Mexico route network)

Hotels & Lodging:

- Marriott International (MAR) (luxury & business travel exposure)

- Hilton Worldwide (HLT) (high dependence on corporate & international guests)

- Hyatt Hotels (H) (upscale properties attract foreign tourists)

- Airbnb (ABNB) (international travelers contribute significantly to bookings)

Car Rentals:

- Hertz (HTZ)

- Avis Budget Group (CAR)

- Enterprise Holdings (PRIVATE) (Alamo, Enterprise, National)

Tourism & Attractions:

- The Walt Disney Company (DIS) (Disney World/Disneyland rely on foreign visitors)

- Universal Parks & Resorts (Comcast CMCSA) (Orlando & Hollywood attract global tourists)

- Las Vegas Sands (LVS) and Caesars Entertainment(CZR) (Las Vegas casinos depend on international guests)

Cruise Lines:

- Carnival Corporation (CCL) (many passengers fly into US ports)

- Royal Caribbean Group (RCL)

- Norwegian Cruise Line Holdings (NCLH)

Online Travel Agencies (OTAs):

- Booking Holdings (BKNG)((Booking.com, Priceline, Agoda)

- Expedia Group (EXPE)(Expedia, Hotels.com, VRBO)

Key Impact:

- Border cities (e.g., San Diego, El Paso, Detroit, Buffalo) would suffer from reduced Mexican/Canadian crossings.

- Major tourist hubs (NYC, Miami, LA, Orlando) would see lower hotel and retail revenue.

- Airlines with heavy Mexico/Canada routes (Southwest, American) would face revenue declines.

A prolonged drop in foreign travel could lead to job cuts, reduced earnings, and stock declines for these industries and companies.

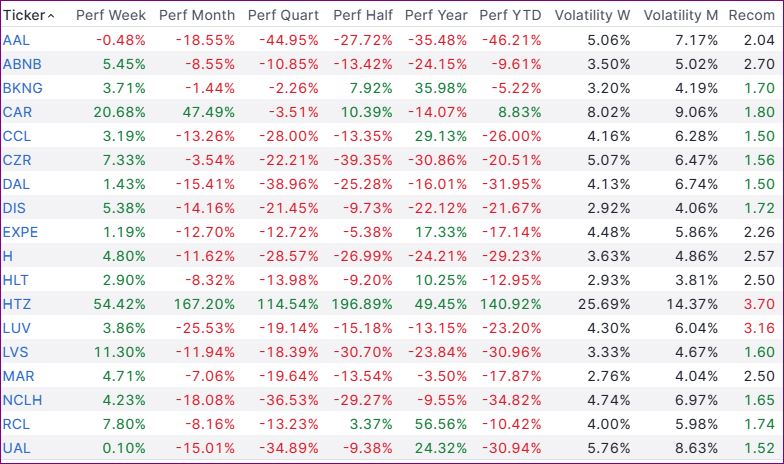

As of 10:am ET, these stocks (ex-CAR and HTZ due to Trump’s stated tax break) are down -12.1% over 1-month and -23.0% YTD.

The stocks are highly volatile, and trade on Trump-related news.