MAY 2017

Investor Account: MASTER ACCOUNT Net Asset Value: $18,407,940 (+0.97%)

May Monthly Strategy Update

World equities shrugged off political risks and concerns about stretched valuations in the market-leading technology sector to grind even higher in the month of May. A scary one-day wipe-out mid-month on news of the appointment of a special counsel to investigate the Trump administration’s Russian dealings, along with a dubious Trump budget proposal which assumes no economic downturn over the next 10 years and a revenue-neutral massive tax cut, left equity markets unfazed by month’s end.

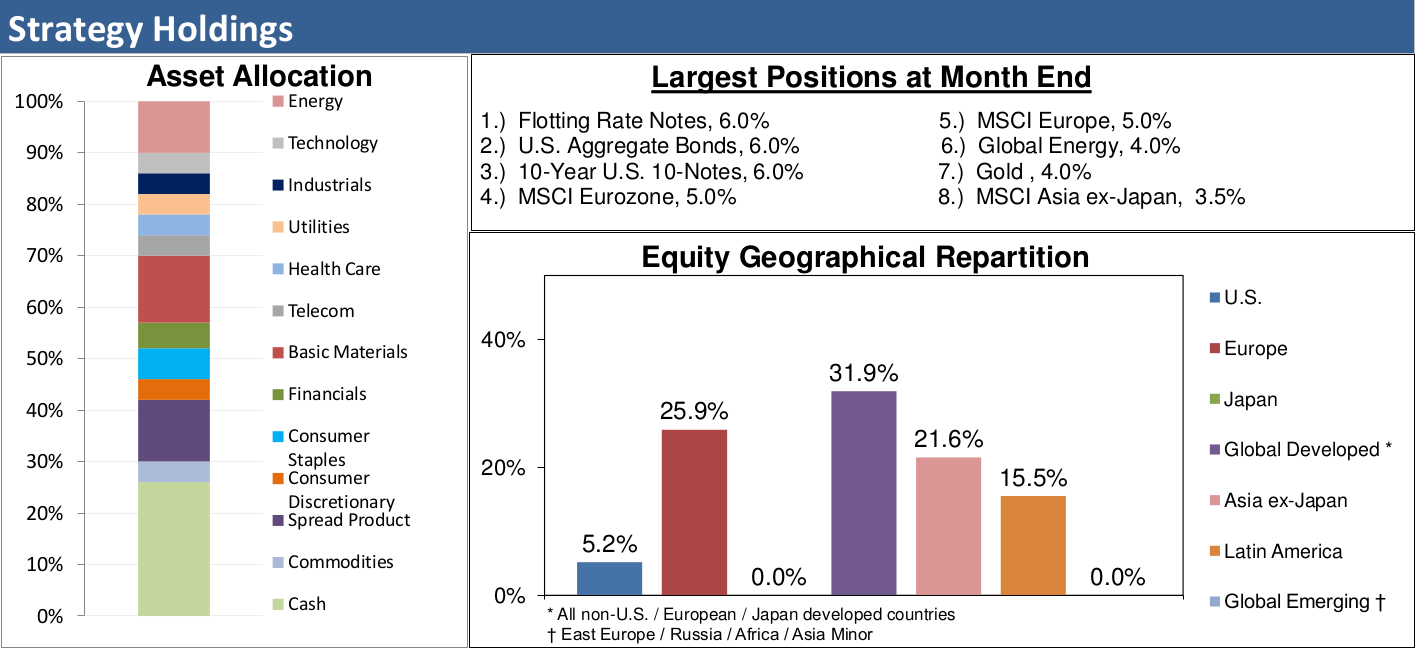

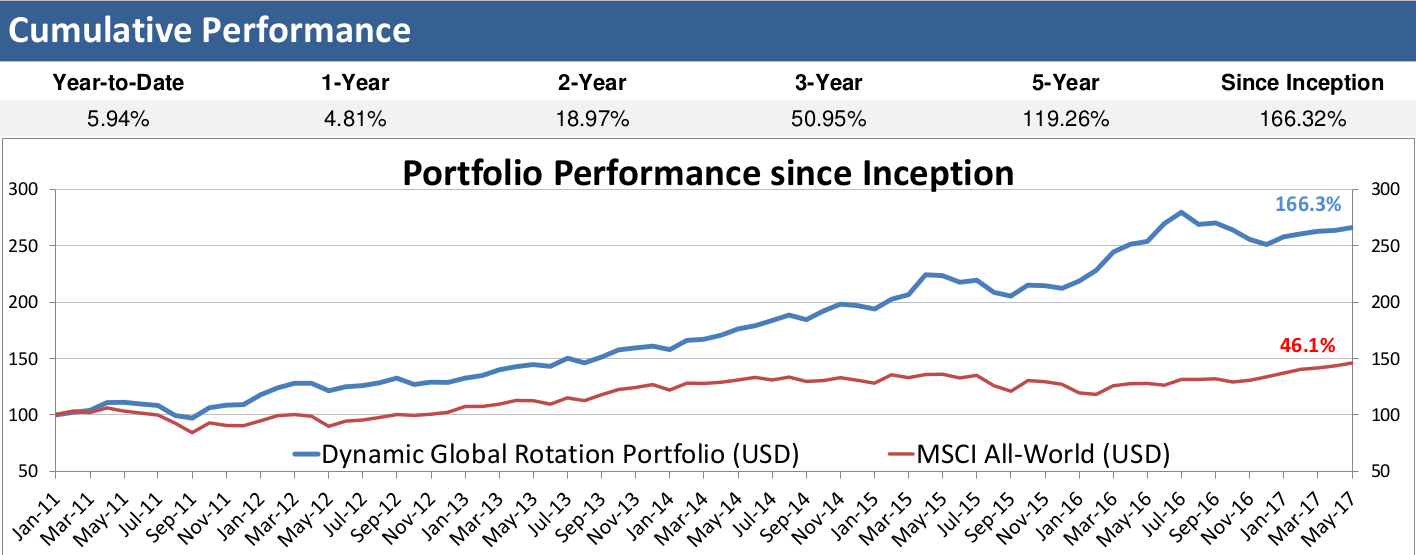

In this context, the MSCI All-World equity index outperformed U.S. equities once again in May (+1.78% vs. +1.16% for the S&P 500). Despite the supposed appetite for risk in the markets and expectations for rising interest rates, the 30-year U.S. Treasury bonds actually outperformed the S&P 500 for the second consecutive month! Our DGR Strategy, despite a capital preservation bias, participated in equity gains (+0.97% in May) as our equity allocation choices (Europe and select Asian markets) have more than offset our defensive positioning (26% in cash, 12% in Treasurys, 11% in gold/miners).

Barring a black swan event, it appears that equity markets will run up until we hit the traditional August/September speed bump. Nevertheless, crowding into stocks, notably U.S. mega-cap tech names that have run-up over +30% thus far in 2017 (on pace for +100% annual gains) does not appear to be a prudent trade, especially in the near-term, considering upside potential versus downside risk. One candidate we like for a rotation out of stocks trading at record highs is the energy sector. Energy companies, down over -12% YTD, will return to profitability as the oil price rises. The Saudi and Russian oil ministers, who control one-third of oil exports, have been telling us to expect $75 oil by year-end. Coupled with the huge draw-down in reserves we’ve seen in recent months, markets could soon wake up to the potential held by energy stocks.